Over the past decade, Woodinville’s housing market has experienced dramatic appreciation:

2015–2019: Strong growth fueled by historically low interest rates (3–4%), tech job expansion in nearby Redmond and Bellevue, and limited inventory. Median home prices rose steadily.

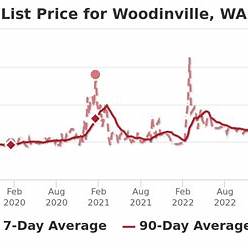

2020–2021: The pandemic created a surge in demand for suburban homes. Remote work increased interest in larger properties with outdoor space. Home values spiked by 20–25% year-over-year.

2022–2023: With interest rates climbing sharply (from ~3% to over 7%), buyer demand cooled. Prices plateaued and even dipped slightly in late 2022.

2024–2025: Modest recovery underway. Home prices have started to rise again, though at a slower pace, as rates stabilize and inventory remains tight.

📌 As of early 2025, Woodinville’s median home price sits around $1.41 million, a strong indicator of its sustained desirability even through economic headwinds.

📊 Economic Indicators and Forecasts

1. Interest Rates

Current: 30-year fixed rates hover around 6.7%.

Forecast: The Fed has signaled potential rate cuts in late 2025 or early 2026, which could further ease mortgage costs and reignite demand.

2. Employment & GDP

Seattle Metro Area: Unemployment remains low (~3.5%), thanks to tech, biotech, and logistics.

GDP Growth: Slower but stable; expected to grow at 1.5–2.2% annually.

3. Inflation

After peaking in 2022–2023, inflation has cooled to around 3.2%, and should continue trending downward, which supports real income stability.

🏘️ Real Estate-Specific Factors in Woodinville

1. Housing Shortage

Residential: Inventory remains tight. New construction is constrained due to zoning laws, high land values, and limited large parcels. Bidding wars still occur in premium pockets.

Commercial: Office and retail vacancies have increased slightly post-pandemic. However, adaptive reuse and live/work zoning initiatives are gaining traction.

2. Rental Market

Rental demand remains strong, especially for single-family homes.

Occupancy: 95%+

Rental Yield: Around 3.5–4%, with luxury homes earning slightly less but appreciating faster.

3. Supply & Demand Balance

Months of inventory: ~1.8 (indicates a seller’s market).

Buyer demand: Highest among move-up buyers, luxury seekers, and out-of-state relocators.

🔁 Comparative Analysis: Now vs. 2007–2009

Factor 2007–2009 Crisis 2024–2025 Environment

Home Equity Low, many underwater High—owners sitting on strong equity

Interest Rates Falling (post-crash) High but flattening

Lending Standards Lax (subprime loans) Strict underwriting

Inventory Oversupply in 2008 Undersupply continues

Foreclosures Surge Very low

🟢 Conclusion: Today’s market is much more structurally sound than 2007–2009, with limited foreclosure risk and much healthier equity positions.

🔮 Predictive Insights: Next 2 Years (2025–2027)

🏡 Residential Outlook

Prices: Likely to increase 3–6% annually if rates decline modestly.

Buyer Pool: May expand with Gen Z entering the market and remote/hybrid workers moving out of Seattle.

New Builds: Still constrained, adding pressure to existing home values.

🏢 Commercial Outlook

Retail centers with high walkability and mixed-use design will perform better.

Older office spaces may continue to face pressure unless adapted for residential or co-working use.

💡 Risks

A potential recession or spike in unemployment could freeze buyer activity.

Prolonged high rates (if inflation rebounds) would delay recovery and erode affordability.

💰 Opportunities

Buyers: Window for negotiation still exists before broader recovery takes off.

Investors: Solid rental demand and long-term appreciation make SFR (single-family rentals) a strong bet.